Even if Twitter, which had 187 million daily users in the third quarter, were to reach 10 million subscribers, Levine said, it wouldn’t be enough. Levine also worries that Twitter won’t be able to entice enough signups to make a subscription business work. “If they’re going to do this and they’re going to get this right, there needs to be some premium content that they are going to lean into that’s going to require investment,” he said. Michael Levine, a senior analyst at Pivotal Research Group, doesn’t think people will pay for ad-free Twitter, but agrees that the company’s best option is to start selling some type of exclusive content. “A subscription offering that either offers more content or removes ads would be well received among Twitter’s more loyal users,” Ron Josey, an analyst at JMP Securities, wrote last summer. It is still unclear which products will eventually reach Twitter consumers.Īnalysts have different ideas about which choices might work best.

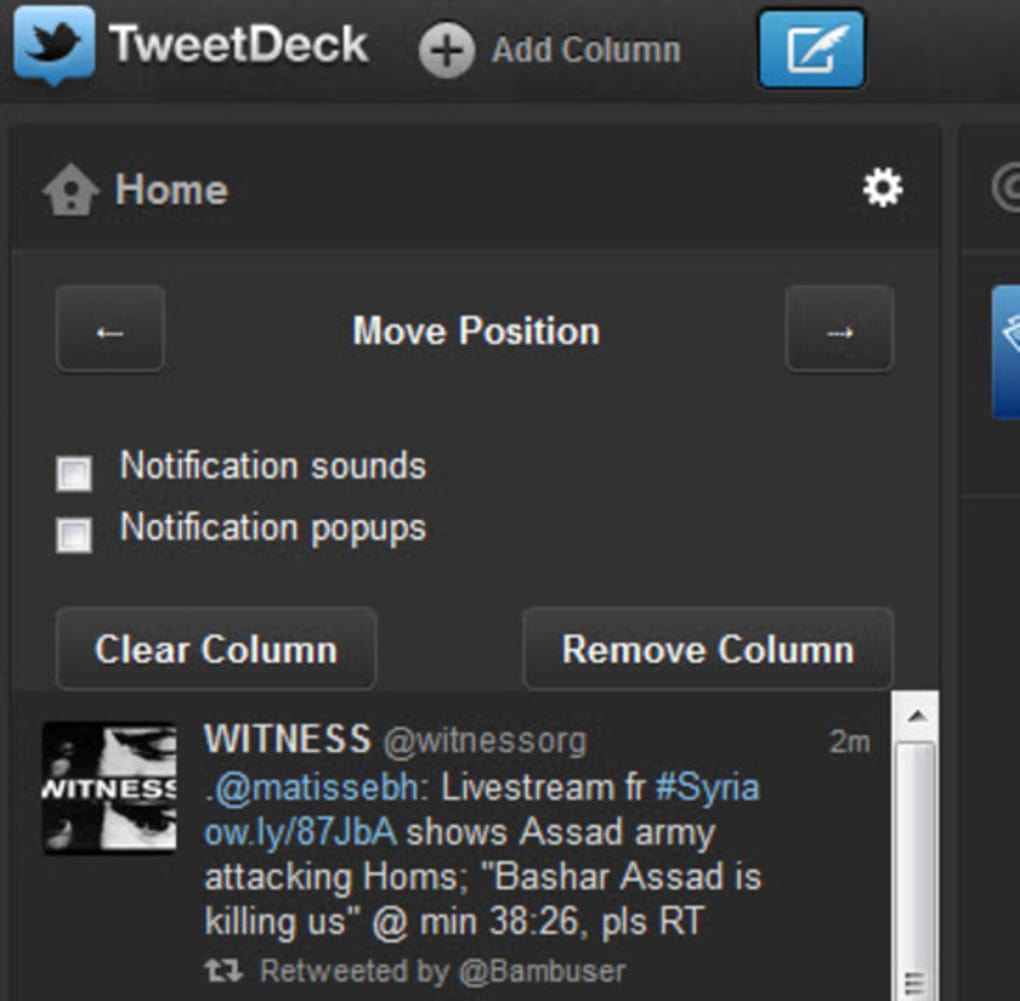

Tweetdeck is currently free, and doesn’t have ads, which makes it appealing to some users as an alternative to the main feed.Ī recent survey from July, discovered by journalist Andrew Roth, also shows that Twitter is weighing whether consumers would pay for special features, like an “undo send” option or custom colors for their profiles. The service is typically used by Twitter’s more advanced users, and lets them follow multiple streams of tweets at one time. The company is also considering charging some power users for a suite of services, which might include Tweetdeck, a sort of dashboard useful for viewing multiple feeds and overseeing different accounts. Twitter would take a cut of the transactions. Twitter tested the idea of user “tips” in the past with its soon-to-be defunct live video service Periscope, and it’s become a popular business model for companies hoping to help creators make money from their fans or followers. Some possibilities for this kind of recurring revenue have emerged based on user surveys, executive comments or past product moves. “While we’re excited about this potential, it’s important to note we are still in very early exploration and we do not expect any meaningful revenue attributable to these opportunities in 2021.” “Increasing revenue durability is our top company objective,” Bruce Falck, Twitter’s head of revenue products, said in a statement, adding that this “may include” subscriptions. For the fourth quarter, analysts project revenue rose 18% from a year earlier to $1.19 billion, with profit estimated to come in at 30 cents a share, according to data complied by Bloomberg.

It has mentioned the idea of subscriptions on the past two quarterly calls – but the company has historically been slow in making product decisions.

#Tweetdeck alternative update#

The San Francisco-based company may update investors on its thinking when it reports earnings on Tuesday.

0 kommentar(er)

0 kommentar(er)